BHPH Report: Since they’ve been used for several years now, how much have payment devices and GPS tracking systems changed the way auto financing occurs in this area of the credit market?

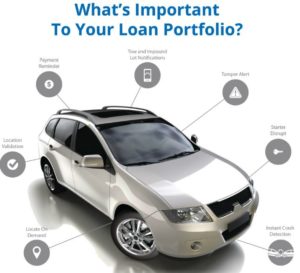

Bill Caan: There’s been a couple of big changes. One is the sophistication of the devices themselves, whether it be going from 2G to 3G or the functionality that the devices offer. They allow a lot more flexibility in the way you can collect on your loans. That being said, it gives you the ability to underwrite more aggressively with the idea that if the loan goes sideways, I can protect my collateral because I can monitor my collateral.

One of the things that will happen over the next couple of years, if it’s not happening already, is that finance companies will start to use GPS tracking devices to monitor risky behavior after the loan has been made. By that I mean, if you think about, everyone has their underwriting scorecard and that’s how you decide how to make the loan. There’s a risk associated with every customer whether it’s credit score, income or down payment, the car. Now you have these GPS devices that can detect risky behavior after the loan has been made. Once you agree to it and fund it, it’s yours. There’s nothing you can do about it. But the GPS devices now are going to help collectors determine when risky activity is happening. They’re going to be able to decide, say, if you got an impound lot alert. The procedure can be to go get the car after one day. If the customer is outside of a 300-mile radius from where he bought the car, that’s potentially risky. If the car hasn’t been driven in a week, that could be risky.

I’m not sure you can manage the incidents, but you could manage the severity of loss. We view GPS devices as being able to cut down on the severity of losses because they’ll have the information when risky activity is happening in the field.

BHPH Report: How careful do BHPH operators need to be as not to soften underwriting simply because of devices’ capabilities?

Bill Caan: You have to be real careful. If you go back to Lending 101, you look at ability to pay, stability and willingness. I’m going to put this guy in a loan he can afford. And based on his credit history, he’s willing to take his paycheck and pay it. You start there.

There’s a false sense of security if you think you can make a loan to anyone because I can just stick a GPS on there. You have to be real careful with that because a buy-here, pay-here dealer controls both sides of the equation. He does the underwriting and the collecting. It’s his money and his car.

If you make a loan just because there’s a GPS on the car, the fact that you get your car back isn’t great. You never want to pick up the car because it’s the last-ditch effort. But at least a buy-here, pay-here dealer can just put it back on the lot and away they go.

But people who underwrite with the GPS on there, you have to take into account what your remarketing costs are as well as the fact the GPS is great when the customer hasn’t tampered with it and it still works. That’s another issue.

You just have to be real careful when you change your underwriting saying I can do anything because I have the GPS on there. You have to look at what your recovery and remarketing costs are, too.

BHPH Report: How closely are federal and state regulators watching the use of devices?

Bill Caan: It’s more on a state-by-state basis right now then a federal basis. We’re addressing through our trade organization a new potential bill in New Jersey. I think there are a whole vanguard of people who are starting to look at the use of GPS.

The CFPB really hasn’t come out with a statement on it. I think they’ve got their hands full with what they’ve got going on right now. I think we can all agree that based on what we believe the CFPB isn’t going away.

One of the things that anyone using a GPS program needs to do is absolutely document what they’re doing. Like everything else for the CFPB, you have to have a complaint section. You have to prove there is no disparate impact with the way you’re using them. You have to be really consistent.

I also think one of the issues that’s coming to the forefront is as a buy-here, pay-here dealer you have to be really aware of who your vendors are. You’re not only responsible for what you do, you’re also responsible for what your vendors do. That’s the next step for dealers, to understand who your vendors are.

BHPH Report: How can these devices help other parts of a BHPH dealership’s operation beyond collections?

Bill Caan: We’re starting to address the use of GPS as a data-gathering device instead of just a pure recovery device. If you look at the risk associated with a car loan, if we can start to let the buy-here, pay-here dealers start to monitor their risk post-underwriting and make decisions based on that, you’re going to cut into the severity of loss. I’m not sure you can change the incidents all that much; that’s more of an underwriting standpoint. But if you start to look at culling information from your device — this car hasn’t been driven, or this car is being driven 4,000 miles a week — all of that information is available through the GPS.

Once we get buy-here, pay-here dealers to start to understand that this is valuable information and they can get a handle on what they should do with their collateral, the lower the severity of loss will be. These cars don’t get more valuable. That’s where this market is going

Learn more about our dealership car gps tracker.